Is the USD Reserve Currency Status Really Under Threat?

And what is a reserve currency anyway?

DJT put out this statement a little while ago. You may have seen it.

As the world’s largest import economy, the US shutting down trade with specific nations could result in anything from roughly nil, to disastrous for the nation depending on its trade relationship with the US. It appears Trump is simply establishing an aggressive negotiating posture — but what exactly is he negotiating?

It’s clear the US capitalist class feels anxious about the emerging outlines of the new multipolar world economic structure. I gather this change took them by surprise as its appearance coincided closely with the outbreak of the Ukraine war. They expected the “ruble will be rubble” as Joe Biden assured and that Russia, and then China, would fall to western economic might and machinations.

At the outset of the war, if you will recall, oligarchic mouthpieces like Hillary Clinton went on the TV telling us Putin was “insane”. We were assured Russia’s economy would shortly collapse as the US unleashed the “mother of all sanctions” against the recalcitrant Russian “gas station with nukes”.

Within months Hillary was again making the rounds but this time she displayed an extreme frustration and even rage that Russia’s economy was doing well (I’ve been trying to find the video with no luck). She probably didn’t know why her predictions never materialized.

If she was a more intelligent student of geopolitics Hilldawg would have known that Russia had in fact carefully prepared in the years since the 2014 Ukraine coup to sanctions-proof their supply chains and manufacturing capabilities against the west. They had become largely autarkic by 2022 with incredible synergies gained from the Chinese alliance. Where China is weak Russia is strong and vice-versa. Russia also has strong trade ties with India and many of the industrial components they no longer import from the west now come from India as well as China.

Some analysts outside the western echo-chamber noted this long before the war began in 2022 but, as with everything else, our incompetent leadership class hear only what they want to hear. To me it seems western leaders, including Trump, don’t quite understand the nature of the ongoing changes to the world economy.

For the first time ever non-western nations outweigh them in GDP terms. Roughly 2/3 of world GDP now comes from the “global south”, Russia, China and India. Threats will not change this fact. That said, none of the BRICS nations have an interest in shutting down trade with the US nor do they seriously plan to replace the US dollar as global reserve currency.

The west bled itself for a few decades and now our “elites” are waking to an unrecognizable world. I had a stark illustration of this myself one day as I perused a set of internet images of massive cities across China and other growing nations that I couldn’t recognize at all. I’m not that old and yet still recall a time when every large city on earth was recognizable to me. Economically speaking the west is not the center of the world anymore.

What I read in Trump’s statement is the dawning realization of the above. Nations in a strong negotiating position don’t threaten. They don’t have to. Sadly the US and Europe have only themselves to blame. I won’t rehash the beginning of the west’s slide during the first round of US/UK deindustrialization in the 1980s. I’ll just remind you of two songs — Bruce Springsteen’s despairing yet defiant Born in the USA and Billy Joel’s Allentown. In the 1980s they were some of the first anthems of deindustrialization and lost hopes for America’s working class.

The trend accelerated in the 90s with the passage of NAFTA and the final collapse of Detroit’s auto manufacturing industry. Since this wasn’t enough for the oligarchy the job was finally completed with China’s entry into the WTO and US-bequeathed designation of “most favored nation” trading status — both in December of 2001.

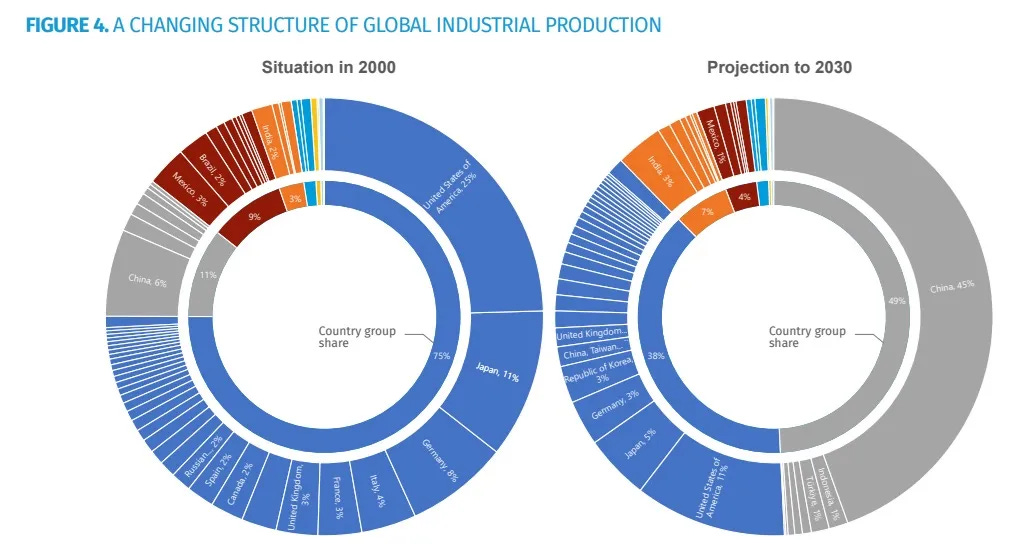

If that doesn’t drive it all home this graph I stole from fellow substackistani Noah Opinion should do the trick:

At this late date what does the US have that the world needs and can’t do without?

The one thing the US still has is the world reserve currency. So let’s take a look at the state of this thing. What is the reserve currency? I’d argue it’s more than one thing but let’s focus on just the precise technical thing itself and work out from there.

The US government froze roughly $300 billion of Russia’s total $600 billion-plus foreign currency reserves at the outset of the war in Ukraine in early 2022. How did it do that?

Currency reserves are stocks of funds (currencies, gold, etc), often kept in a nation’s central bank and other large financial institutions inside and outside the country. For all large nations they are spread across the banks of many nations. These funds are used for a variety of purposes. They maintain international trade payment balances, help maintain stability of a nations currency float relative to other currencies, contribute to investor confidence in a nation’s solvency and other related purposes.

So again, the US froze the roughly half of Russia’s foreign reserves held outside of the country in 2022. At the time Russias reserves were held in European (25%), Russian (22%) , Chinese (14%), Japanese (10%), and American (6.5%) banks. The rest were held in other banks around the world including in the UK and Canada. The final status of those frozen funds is unclear at this time while their seizure is unprecedented.

US and European banking lawyers are trying to figure out some legal-ish way to seize Russia’s reserves but so far they are finding this difficult. The laws that control disposition of foreign reserves for war reparations are unclear at best and there aren’t any major precedents for such an action. That probably won’t stop the US/Europe from stealing Russia’s currently frozen reserves to pay back Ukraine’s debts. It will leave Europe on the hook for this illegal act because most of the seized reserves were held in their banks.

When vulture funds purchased billions in defaulted Argentinian debt for pennies on the dollar over a decade ago they were able to grab a big chunk of Argentina’s foreign reserves (held at the Federal Reserve in NYC). This thanks to friendly New York judges and, just as importantly, the fact that Argentina had actually defaulted on its foreign debt.

When the US military fled Afghanistan in 2021 the Biden administration froze $7 billion in Afghani foreign reserves. So far the US has sent a bit less than $3 billion to Afghanistan to prevent the country from collapsing into mass starvation. I imagine it’s inevitable that money will be taken back from Afghanistan’s frozen reserves.

The precedent has been set. The US will unilaterally (with the groveling obeisance of its vassal states) seize any funds from recalcitrant nations without following international law. The Biden administration did not consult the monetary experts at the Federal Reserve when they seized Russia’s reserves in 2022. The Fed was reportedly opposed to the move. If the US government can seize Russian reserves what nation’s reserves can’t it take? The only nation that the US can’t realistically do this to is China.

This is the environment within which the BRICS bank is taking shape. From 2000-2023 worldwide foreign reserves held in USD went from 71% down to 60% in an uneven line:

International trade is still dominated by the USD. Reserves are used to facilitate trade. The dollar accounted for 96% of trade invoicing in the Americas, 74% in the Asia-Pacific region, and 79% in the rest of the world from 1999 to 2019.

International investment is similarly dominated by USD. US Treasury notes (shorter term) and bonds (longer term) are the value store of choice around the world. The USD is the currency everyone runs to when geoeconomic stability is threatened. There is no other nation with enough currency in foreign hands to even begin to replace the dollar.

The USA made a choice around 50 years ago to flood the world with USD and USD-denominated debt. They did this for a variety of reasons — some understood at the time and others only coming to light later on. The US government actually hired author and economist Michael Hudson to explain the system they had engineered to them. The book he wrote that impressed them was the first edition of Super Imperialism.

The original impetus for this flood was that the US was finding it increasingly difficult to finance its foreign military adventurism. Inflation was rampant in the 1970s. By closing the gold window for good in 1973 the US ended the USD-gold conversion system and untethered USD from anything but the floating exchange rate system used to this day. At the same time the US made a deal with Saudi Arabia to only price and sell oil in USD. This established the petrodollar system that forced most every nation into the dollar orbit. If you wanted oil you required dollars and since everyone needs dollars the US could export away its inflation problems. Thus the magic money printer was born.

Since that time no nation has either wanted nor attempted to unseat the dollar from its status as world reserve currency. In order for China to even attempt to unseat the dollar they would have to become a massive borrower and net importer of foreign goods which would result in a flood of RMB exiting China for other parts of the globe. China has no interest in doing this. They are a manufacturing export economy and plan to stay that way. They see the US policy of offshoring and hyperfinancialization as a case study in what not to do. A synergy exists in this relationship. It is, however, not one that greatly benefits the American people.

Getting back to the BRICS bank we can see that it has little to do with reserve currencies. The bank was created to help Eurasian, African and South American countries build out their infrastructure and develop. If anything it has a role similar to the IMF but without the abusive “structural reforms” the IMF routinely imposes:

crushing labor unions,

plundering pensions and other government funds

IMF tells you what you are allowed to grow/build with the funds

So if the BRICS bank and its proposed currency are a threat to anything it’s the IMF. Any currency proposal from BRICS, whether a “special drawing rights” SDR currency (a proportional combination or “basket” of the currencies in the union), or if they simply pick one nation’s currency (it would be China’s RMB) comes with a whole host of potential problems that center around loss of sovereign economic control.

It is not clear how much of this Trump understands but threatening confiscatory tariffs based on a misunderstanding of the threats to the US reserve currency status may drive nations away from trade with the US. This is not necessarily a bad thing unless you’re an economics guy who believes that international trade and globalization-maxxing are the ne plus ultra of economic structures. That said it’s preferable for the US to initiate any international trade curtailment policies rather than have them foisted on us by frightened nations seeking other markets for their goods.

There are very good reasons the USD dominates foreign currency reserves and should continue to do so for the foreseeable future. The main reason, as I described above, is that the US is a massive net importer. USD finds its way everywhere we buy goods. Why? Because unlike most other nations (who largely use a foreign currency for international trade — USD) the US purchases foreign goods in its own currency. Once the world began to accept and use the USD for purchases of oil (the petrodollar) and other commodities in the early 1970s it became the currency-franca, if you will, for investment and trade. When we talk about “reserve currency” we can refer not just to the narrow technical focus on reserves but all of the uses the world has for USD: investment, trade and foreign currency reserves. These are all intricately interwoven since the existence of such a huge mass of dollars combines with the US’s deep and liquid markets and imports (export of USD).

Another reason for the USD being the preferred currency for all the above is that foreign banks from Japan, Europe, UK, etc can all borrow USD from the Fed discount window just like US banks as long as they have a significant presence in the US. The US has very detailed legal and bureacratic rules and infrastructure to handle trade disputes fairly. Foreign parties know they will generally receive a fair hearing in US courts. The importance of this cannot be overstated. If your company has a dispute with a Chinese firm and you try to sue them in China good luck.

For the above reasons and others China, etc. are happy to hold USD and US debt. I should note that despite all the fearmongering about China holding the US hostage with our debt, China actually holds relatively little US debt. Currently they hold around $760 billion — and even at its height their state holdings were only around $1.6 trillion. It’s apparently not known how much US debt Chinese state and private firms hold so that’s a potential caveat. That said, roughly 80% of all $35 trillion in US debt is held domestically and all of it is in USD — not some foreign currency that can be manipulated against us.

So while it’s true the BRICS and some other nations are slowly working to trade in their own currencies this itself presents them a whole host of potential pitfalls and problems.

Here is Yves Smith of NakedCapitalism.com to help explain and reiterate some of what I wrote above [emphasis added]:

There’s no obvious candidate for a successor reserve currency. Even though China has the economic heft, it does not want to run the sustained trade deficits necessary to get its currency widely held outside China. Moreover, for non-Chinese nationals to be willing to hold Chinese currency, China would need to develop deep and liquid financial markets where non-Chinese could have some confidence in regulations and the legal system. Like it or not, the US, even though it has fallen below its pre-deregulation level of conduct, is still the least bad choice in this regard. Access to justice here is money based, not nation based…

So those who want to steer clear of the dollar can do so, but bilateral trading will tend to result in some countries winding up as holders of the currencies of their trade partner, which will be something of a dead weight unless they can invest it. That BTW is true of dollar holdings when they become large, but after the Asian crisis, many countries have seen it as desirable to hold significant central bank reserves, with a big chunk in dollars, so they can defend their currency in a crisis and avoid the tender ministrations of the IMF.

Again, the dollar refuseniks intend to build new institutions to replace ones like the IMF. But it’s much easier for a single power to design a new architecture when the old order has been largely laid waste, than for multiple parties, each with their own interests, to agree on new rules and bodies, and then take the steps to give them real authority, which involves ceding national sovereignity.

That last bit is key. The big dog on the block in BRICS is China. The more dependent on RMB the other BRICS nations become the more dependent they become on China. Also, the yuan/RMB is not a worldwide investment vehicle the way the USD is. Even countries that are net exporters to China aren’t sure what they will do with all that Chinese currency. What will Russia do with its roughly $20-25 billion yearly intake of RMB? Funnel it to the BRICS bank? Possibly.

The USD has the incredibly powerful “first mover” advantage and realistically, the world’s dependence on it for smooth economic functioning is not going to significantly change anytime soon. That said, the more the US abuses the foreign currency reserve system and plays loosely with heavy tariffs and sanctions, the more impetus other nations will have to find alternatives and alternative trading partners.

And before you raise the specter of the new payments system Russia and China have set up against SWIFT I will say this will not fundamentally alter that calculus. What it will do is allow nations who use it to evade US sanctions. Good. We abuse that extra-legal system far too much. It has hurt Iran but Russia is largely sanctions-proof and if we ever try to go far down that path with China it will bite us hard — until and unless we figure out how to significantly decouple from China. And that’s a project that will take careful and measured policy changes.

The upshot of all this is that the USD is still king. And despite some headwinds and the unlikely possibility of a collapse in the dollar system we have room to lose some USD demand without serious repercussions. The world has every interest in maintaining a strong dollar since mostly everyone holds large USD reserves and relies on the currency for most of their trade and investment. China certainly has no interest in rocking the boat (they do not want to disrupt their US trade flows) and they’re the only other really big boy.

In a strong sense the only thing we have to fear is fear itself and that is why Trump’s statement makes me a bit uneasy. US oligarchs and leaders seem to think the non-western world is seeking to destroy us. This explains the bellicose nonsense over Taiwan. The US can afford to share power more than it has as long as we make the right policy shifts and investments at home. In the final section I will take a stab at prognostication on this front.

The above happy tale about the USD notwithstanding, the US is in a bind. From what I can glean the incoming Trump administration wants to reshore commodities production and manufacturing to the US — especially in critical industries. The problem is our economy is centered heavily around finance and cheap imports. We are also a very high cost economy thanks to the unprecedented financialization of the last 3-5 decades.

See this piece to understand the past three decades of high inflation (hint: food price inflation is only the latest result of longstanding inflationary policies):

What Does Inflation Have To Do With MAGA and Its Enemies?

A lot going on these days. Trump will be taking office in 2 months. He was likely elected because most people can’t afford food. Elon Musk and DOGE want to slash and burn the Fedruls and that Office Space meme is everywhere. Finally, as always, Tucker Carlson keeps telling me all about inflation and what causes it. Hint: he knows just enough to be dange…

Converting the US into a largely self-sustaining world island after 50 years of doing the opposite is not something that can be carried off with ease. For one thing, as the US reshores it will stop exporting as many dollars. This will necessarily reduce foreign reliance on USD since it won’t be available in the same quantities. It could also generate a demand-supply deficit which could lead to a stronger dollar as nations bid higher and higher against each other for dollars. This would make imports cheaper which would work against tariffs. Going from a net importer to somewhere closer to a break-even import/export economy would massively alter USD outflows to the world.

Supply shocks in crucial commodities and components could easily occur as well. The US will need to be nimble to avoid the worst of such consequences. Trump’s appointment of Peter Navarro to work on trade issues is a good sign since he’s a competent expert.

This is all very complex stuff and there may be ways to finesse a lot of this. However, ultimately, the level of USD in circulation around the world is a function of both the level of US treasury borrowing (to fund government spending and management of bank reserves via the Fed) as well as our status as massive net importer. So giving up our addiction to imports could very likely impact US reserve currency status. How much is not clear and realistically we could still remain a net importer while bringing vital industries back home.

The way to do this is to experiment. A lot. See what works and what doesn’t by trying things out. That will require good faith — something in short supply these days. Going slowly and carefully and focusing on specific industries that offer the most protection for US citizens and national security is the best option. Industries like steel and other commodities used to produce vital products such as cars, munitions, medicines and medicine precursors must come home. We are already working on bringing chip making here from Taiwan — one of the few good things the Biden administration started on.

Another big problem is competition. The US being a high cost (housing, food, healthcare, education) economy means people need a much higher living wage than in China (or anywhere else outside the EU/UK). Financialization is bleeding us out. While banks do very well when all sorts of things cost a lot the nation as a whole suffers. Tariffs on imports will play a huge role in protecting our reshoring efforts. Even if we cannot compete against nations like China in the export economy at this time we can at least produce for domestic use if we put high tariffs on those import products we identify as crucial for US national security. Germany succeeded despite it’s high cost economy by competing in quality and perceived quality. We can do the same.

Again, the problem is a large part of our economy is geared towards cheap imports from China. Wrecking German industrial might and bringing it to the US (arguably the primary goal of the Ukraine war) could seriously help and frankly, fuck ‘em. They’ve lived large off of the US for 80 years now to the point where their kids routinely take 10 years to complete university, have full healthcare and comfy old-age pensions while we live in a pile of shit. They also parade around as moral paragons and sneering intellectuals scoffing at guys like Trump who are about to eat their dinner. A strong dose of reality is what the effete assholes that run Europe need and we’re just the guys to do it. It’s a dog eat dog world and we will eat your dog.

To sum up, the US still has some strong hands to play. Controlling the world reserve currency means we could reshore and have the rest of the world pay for a significant part of it. Think Trump’s “Mexico will pay for the wall” but on steroids. It means far more select and careful deployment of our magic money printer. No longer will the banks be the primary or sole beneficiaries of that fantastic machine. And if Trump avoids the horribly inefficient looting op that is the public-private partnership model for rebuilding our infrastructure he might just make a go of it.

I’m glad to see Trump shake things up and put globalists and other nations on their back feet. Ultimately he will need buy in from the American oligarchy to really achieve his goals. The good news is he’s a fantastic salesman and has some very effective arguments for strategic reshoring. None of these guys like seeing NATO lose in Ukraine and I think that particular wake up call is scheduled for somewhere around January 20th.

Please like and subscribe if you enjoyed this post. It’s fun to hear from you so feel free to comment as well. My posts range all over the place from geopolitics/econ/finance like this one to music, film, politics and the mechanics of conspiracies so feel free to browse around.

Excellent and thorough description of the predicaments faced by the US and Trump admin. I also see his statements as bluster to establish negotiating position. He always does this, always has. He did it long before running for office.

The reshoring of semiconductors began with Trump admin, initially by dictating that all US government and government contractor tech contain chips from approved locales, i.e. NOT China. I think Trump is part of the Fortress America faction of the Deep State, probably so is a somewhat reluctant at first Elon. This is absolutely vital to long term interests of the US AND benefits Americans in the long run.

Other factors that affect all these dynamics, movement into viable USD alternatives for wealth preservation, money transfers, etc. such as XRP, BTC, ETH and even PMs actually bolsters, at least in the medium term, USD because it is needed to make the trade initially. So all these alternatives should rise, but so will USD during the transition, which could take many years.

And USD are also created completely or largely outside control of the Fed. USD accounts in larger foreign banks can create USD the same way commercial banks do in the US. This is a factor that is overlooked by the Fed, or at least they rarely if ever comment on it.

With Navarro, Bessent and others in his cabinet, I think he will have top notch advisers who will not merely be looking out for the banksters.

But as you say, all of this is a delicate operation, no matter how brilliantly it is handled, there will be significant shocks inside and especially outside the US. Tensions will rise. And to Hell with the economists who selectively quote Smith, Riccardo et al. None of the classical economists would approve of the trading status of the current US/China trade. Mercantilist does not begin to describe communist China. They are far beyond that.

I would love to see as complete a decoupling from China as much as possible. China is a gangster regime that was made powerful by nefarious leaders in the West who knew exactly what they were doing at the time. I personally opposed the opening of trade with China, I was living here at that time as saw first hand how they did business. I was hardly alone. Many people who dealt directly with Chinese companies were saying it was a huge mistake, but of course greed wins ultimately and the commies played their cards perfectly. If the West were as good at the long game as China, we'd be living in a very different world. But I am now convinced that the demise of the West was intentional from both sides. Americans were betrayed deliberately and maliciously by the worst people on the planet, not just the Bushes, Clintons, et al, but corporate leaders, especially the bankster class.

The US and Russia should be natural allies. But once again, greed won. Instead of a healthy long term relationship that could diminish and perhaps oust the CCP, the Ivy League psychopaths decided that the Russians had no right to determine how exploit the vast resources under their control. This is ultimately how we got into this nonsense, gross and probably deliberate mishandling of the collapse of the USSR. But that is another story altogether and I've vented long enough here.

Great stuff. Thank you for posting it.

«So what Michael did in Super Imperialism was important for me. I elaborate on this argument in my Geopolitical Economy, which was published in 2013. In this book, I basically show — one of the best ways of introducing this book is like this: You may have heard people say that the dollar was once hegemonic and it is no longer so. You may have heard other people say that the dollar has always been hegemonic and will always remain so. But you’ve never heard people say that the dollar never really managed stable hegemony. And that is the argument of Geopolitical Economy.» © Radhika Desai